Jeron Paul is the CEO and founder of Capshare. Capshare is trusted by over 7,000 companies to manage cap tables and equity compliance all in one place. This post originally published on the Capshare blog.

If you are an experienced or even a first-time SaaS entrepreneur raising capital, you’ve probably heard about several “magic” metrics that every investor wants to see before they decide to invest. Some of the most common include:

- Recurring revenue—typically monthly recurring revenue (MRR) or annually recurring revenue (ARR)

- Growth in recurring revenue

- Lifetime value of your customer (LTV)

- Customer acquisition costs (CAC)

- LTV / CAC

Whether you’re looking to raise capital or you’re simply tracking the health of your business, all of these metrics are handy. However, if you’re looking for capital, you can bet your bottom dollar that most investors will scrutinize these metrics. The thing about investors is that they’re suckers for data, so they’ll most likely take any data you give them.

But knowing that investors are interested in data doesn’t necessarily help you raise capital. It’s knowing which metrics investors will not only want, but the ones that will convince them to invest that will get your startup off the ground.

In this post, we’ll help you take the data you already have and give you a thorough overview of which SaaS metrics potential investors will drool over, so you can start tracking and preparing an impressive, capital-raising portfolio.

We’ll start at a high level but quickly get into some nitty-gritty details, so feel free to skip to the sections that are most important for you.

What Investors Want

Have you ever heard that the Eskimo have 50 different words for snow? If we lived in the Arctic, we’d probably have a vast vocabulary for snow as well.

Similarly, VCs live and breathe investment, so the vocabulary for their business is pretty comprehensive. You might’ve heard investors talk about “liquidity events,” “outsize returns,” “x-factor returns,” “fund returners,” “10-baggers,” “exit proceeds,” “beta,” “beating the market,” etc.

All this vocabulary really comes down to one thing: return on investment (ROI). Investors get the best ROI when they buy low and sell high.

Return on investment, or ROI, is:

(Gain from Investment – Cost of Investment) / Cost of Investment.

Investors want the highest possible ROI for each of their deals. The higher the number in the ROI equation, the more money an investor will make for every dollar they invest.

Although the equation may look straightforward, there are a number of other factors that affect investment returns, such as time. For example, if you invest $1 and you gain $1.50, that’s a good deal, right? After all, you’ve made a profit.

But what if it took you 10 years to gain that $1.50? Maybe the deal isn’t so great after all. You might’ve been better off keeping that $1 in the bank because you probably would’ve earned the same return without the risk.

Speaking of which, risk is another factor that can skew the ROI equation. Startups fail at a rate between 75 to 90 percent, which means that every ROI venture has a large amount of risk built into it. Because of the heavy shadow of risk, investors need to believe that the number they’ll get on the other end of that equation will be a rather large one.

Trained investors know what to look for when deciding what business to invest in. They use the ROI equation while also adjusting for the effects of time and risk to see an exceptional return. This practice is called looking for “excess returns,” or “outsize returns.” What they’re looking for, even after figuring in the risks, is something that is worth more than the gamble they’re taking.

Recent technological advancements and the boom of SaaS startups have made it possible for VCs to generate incredible outsize returns. Successful SaaS companies like Workday, Tableau, LinkedIn, and Splunk returned 100x+ the VC’s investment.

When deciding whether or not to invest, VCs will be taking a magnifying glass to your metrics to see if they can divine these kinds of outsize returns.

Venture Investors versus Traditional Investors

Both Venture Capital investors (VCs, or venture investors) and traditional investors take on risk and expect a good ROI, but where they differ is in their strategy and structure.

Let’s put it this way: VCs feel your pain to some extent. That’s because they have to raise funds in order to invest. They get their funding from even bigger investors called “LPs”, “limiteds” or limited partners in dedicated funds. That’s why venture capital firms are also called VC funds. VC LPs expect a return on their money as well.

VCs only make the big bucks when they pay back all of the money they raised. This happens because LPs agree to give most VCs about 20% of any profits after the VC returns the money raised from the LP.

VCs call this “returning the fund.” So to be successful, a VC has to return its fund and then generate quite a bit more return.

How do they do it?

VCs buy stock in privately-held startup companies at very early stages when the stock price is still low, but has the potential to grow enormously. This means taking on colossal risk but it also means that there is a possibility of a very sizable return. Basically they try to buy low and sell high.

For the earliest-stage VC investors, they must target 60% annualized returns on every investment because many investments they make will fail.

Wealthfront explains that the traditional industry rule of thumb has been to look for deals that have the chance to return 10x your money in five years, which works out to an IRR of 58%.

Because startup investments are such a gamble, VCs are what you might call “picky.” Former VC, Dileep Rao, says in an article in Forbes that “VCs finance only about one or two ventures out of 100 business plans they see. They reject the other 98-99 percent either because they are not in the preferred industries, have not displayed the potential or the proof of potential, have not been referred by the right person, or any one of many reasons.”

Dileep breaks the statistics down even further, saying, “According to the Small Business Administration, about 600,000 new businesses are started in the U.S. each year, and the number of startups funded by VCs was about 300. This means that the probability of an average new business getting VC is about 0.0005 (300/600,000), and it also means that 99.95 percent of entrepreneurs will not get VC at startup.”

This means that if you want to attract investors, you should paint a data-driven picture that shows why your company’s stock price will grow rapidly over the next few years. This will help bolster an investor’s belief that the risk they’re taking on when they buy low will be rewarded with the opportunity to sell high in the future.

Most VCs will only invest in a new startup if they believe that their return on investing in that individual startup has the potential to return the entire fund they have raised from LPs.

It doesn’t hurt to do your research on VCs and the market for investments, either. Knowing which VCs are investing during which stages and for which products can certainly be helpful when you’re browsing for investors. If you want to know current VC investment trends, PwC MoneyTree offers fantastic reports per quarter.

Your goal is to wow investors by showing them how your particular startup can return their entire fund and make them some big bucks in the process. You can do that best by demonstrating how you will dramatically increase your company’s shareholder value.

Shareholder Value

First of all, I’d like to begin by saying that, while shareholder value is an enormously valuable metric, it should not be the only thing your company focuses on.

It may be tempting, but if your sole concern is shareholder value, you may soon find that your company has no soul. Or customers. Or profit. You get the picture.

That being said, shareholder value is critical to wooing investors, so understanding the math of shareholder value is time well spent if you’re looking for investment.

To put it simply, shareholder value is the value of a company to its shareholders. However, the definition gets a bit more technical when you start looking into what qualifies as a shareholder.

If you look at a company as an indefinite stream of cash flow, then shareholders are interested parties that can claim portions of that stream. There are different classes of these interested parties, including:

- Equity shareholders—those who own common or preferred stock

- Derivative holders—those who own options or warrants

- Debt holders—those who have loaned money to the company and want it repaid

At its narrowest definition, “shareholders” would only include equity shareholders. However, a broader definition would include anybody who has a claim on the company. Industry experts often call these people “stakeholders” to include both narrow “equity shareholders” and other, broader definitions of owners. Even within the realm of equity shareholders, there are subcategories that include the interested parties of equity series.

The main thing to keep in mind is that, in most cases, increasing company value increases shareholder value. And remember, increased shareholder value equals happy investors.

Keep in mind that just because preferred shareholder value almost always increases as company value increases, the same isn’t true for common stock. This is because of liquidation preferences. Because of liquidation preferences, common stock is sometimes excluded from the increased value of the company. Sadly, these important exceptions generally affect entrepreneurs more than investors.

What Drives Value for SaaS Companies

As I mentioned before, SaaS companies can best be viewed as indefinite streams of cash flow. Most SaaS companies, especially startups, are cash flow negative or neutral at best, and the majority of them anticipate negative cash flows for an extended period of time.

It is more accurate, then, to think about a SaaS company’s value as the probability that the company will eventually have enough positive cash flows to offset negative cash flows.

This is not to say that current cash flows aren’t important indicators of value. It’s just better to say that a belief in even bigger future cash flows is a better indicator of value for most tech companies.

Investors frequently minimize the importance of current cash flows if a company is growing really, really fash. Growth helps bolster investors’ belief that either 1) the company will eventually create big cash flows or 2) that enough future investors will believe in the company’s potential, motivating them to act on their instincts by bidding up the stock price.

In a way, startup value can sometimes be a self-fulfilling prophecy, and venture investors are often self-fulfilling prophets.

How To Increase the Value of Your Company

OK, put on your b-school hats, sing your b-school section song, or whatever gets you back into the spirit, because we’re about to get crazy financial for a second.

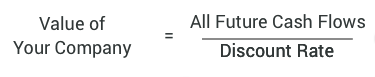

Remember your little friend from b-school, the discounted cash flow (DCF)? The DCF holds the key to understanding how to increase the value of your company—or really any company for that matter.

In its most basic form, the DCF is just the value of future cash flows divided by a discount rate.

You can further simplify to something like this:

Based on this equation, there are two ways you can increase the value of your SaaS company:

- Increase your company’s anticipated cash flows, OR

- Decrease your company’s cost of capital

Let’s look at each of these briefly.

Increasing Your Anticipated Cash Flows

If you’re reading this you probably already have a financial background, so you know that increasing your cash flows isn’t really rocket science. Basically, you can do it in two ways:

- Grow your revenue

- Increase your profit margin

We’ll touch on this in a bit more detail below, but we’re going to assume that you know the basics about growing your revenue and increasing your profits.

Decreasing Your Company’s Cost of Capital

Cost of capital is quite a bit more complicated and misunderstood, even by seasoned finance execs. Cost of capital refers to the promise you make to potential investors when persuading them to invest in your company.

It can best be understood from the perspective of ROI.

In our earlier discussion, we defined ROI for investors as:

ROI = (Gain from Investment – Cost of Investment) / Cost of Investment.

The ROI equation for companies shows that your company will be worth more when there is less invested capital needed to generate profits.

When you think about it, it’s pretty intuitive. For example, which company would you expect to be worth more: a company that generates $10M in revenue after a $100M investment, or a company that generates $10M in revenue after a $1 investment? The answer is pretty obvious.

To convince investors to lend you money, you may have to make a few concessions. These concessions are the cost of capital.

For example, you might need to offer investors large amounts of equity. Or maybe the investments you secure come with high interest rates.

Both of these deals affect your company’s cost of capital. If you have to give up a lot of equity or pay high interest on money you raise from investors, this means that raising money to invest in your business is relatively expensive, and companies that are expensive to run are worth less than companies that are relatively cheap to run.

I know what you’re thinking: “Okay this is all fine and well but how do I decrease my cost of capital?”

Cost of capital primarily relates to the level of risk investors assign to you. But keep in mind that you do have some control in this matter. To reduce the appearance of risk, you can:

- Show investors why your business model is sound

- Talk to investors about why your market opportunity is safer than it might appear

- Demonstrate good unit economics and financial growth

- Minimize signs of riskiness in your business—primarily churn rates

Doing these things also has a double-whammy effect on the value of your company—it increases your cash flows and the discount rate of those cash flows.

The Relative Importance of Revenue, Growth and Profitability

Companies can create all kinds of revenue streams including negative, neutral, and positive. While negative or neutral streams do not necessarily correlate with lack of value for SaaS companies, those that have positive streams are still the most valuable. Companies that show a rapidly increasing stream of positive revenue are very interesting to investors, indeed.

Is it any wonder, then, that total revenue correlates very strongly with total value for public companies or that growth rate is about twice as important to SaaS-company valuations as profitability is?

Nobody knows this better than Amazon. Amazon famously took years to achieve profitability. Even now the e-commerce giant tends to prioritize growth over profitability because they know investors value them based on projected cash flows. They must be doing something right because their stock price is trading at record highs.

It may seem obvious, but if you want to increase value, turn your company into a bottomless stream of revenue.

The growth vs profitability valuation equation for SaaS companies looks like this:

Key Insight #1: There is nothing that will make a venture investor do a double take faster than meteoric growth in revenue.

Rapid growth is the single biggest factor for attracting venture capital. So what exactly is rapid growth? It depends based on your investment stage, but there are a few important benchmarks:

- Pre-seed: Monthly growth of 15-20% or more

- Seed: Monthly growth of 15% or more

- Series A: Monthly growth of 12% or more

- Series B: Monthly growth of 10% or more

- Series C: Monthly growth of 5% or more

As Wealthfront mentions, there is another, less obvious reason to focus on growth: “There is a huge incentive to grow faster rather than generate profitability. This may sound like heresy but it’s the way the technology business has always worked. Almost every market leader could generate a profit relatively early in their life, but that would leave them open to an aggressive new entrant that wanted to change the rules on them. It’s far better to defer profitability and cement your lead than try to make a profit early.”

Does this mean you should do whatever you can to drive growth? On a certain level, yes. Some of the smartest investors in the world have highlighted the unique importance of growth. Paul Graham, one of the foremost early-stage VCs, literally defines startups as startups = growth. After all, you have to “start up” from somewhere, am I right?

But there is a problem with this approach. It turns out that the easiest way to grow really, really fast is to sell something for less than what it’s worth.

For instance, if you open up a “lemonade stand” where you sell $20 bills for $10 each, I guarantee that you’ll see an obscene amount of growth. In fact, you’ll sell as many $20 bills as you can get your hands on. But obviously this method of growth is not sustainable.

This leads us to the idea of unit economics.

To learn more about the relative importance of revenue, growth and profitability for SaaS companies, check out a blog post we wrote specifically on this topic.

Unit Economics

Unit economics refers to revenue, profit, value, and other key business metrics expressed on a per customer basis. So, instead of looking at the value of a company as a whole, in unit economics you would look at revenue, profit, value, and other key metrics on the basis of one individual customer.

As we demonstrated with the “lemonade stand” business, it’s possible to grow really fast with a bad business model. Although your growth may look impressive, an experienced investor looking at unit economics would quickly realize that you are losing $10 for every new customer you sign up. The business is indeed growing, but it’s also destroying more value the more it scales. This is why most investors will ask to see the unit economics of your company when deciding whether or not to invest.

Above, we talked about how revenue, growth, and profits drive company value. To look at unit economics, we will talk about how revenue per customer, growth per customer, and profit per customer drive company value.

It turns out that there are really only 6 critical metrics that SaaS businesses need to show investors.

#1 LTV / CAC

The ultimate unit economics metric for SaaS investors is LTV / CAC. Not surprisingly, LTV / CAC is just another form of ROI.

Lifetime value of a customer (LTV) is the net present value of all of the cash that a customer will pay for as long as they remain a customer.

Customer acquisition cost (CAC) is the total amount of money your company spends (on average) to acquire a new customer. It includes all sales and marketing expenses such as the salary and commission you pay your sales and marketing professionals.

If your LTV is less than your CAC, the search for an investor will more closely resemble a search for a needle in a haystack. Most SaaS investors like to see LTV / CAC ratios in excess of 3-5x. That means that your LTV should be 3 to 5 times as large your CAC. I know. Investors are demanding.

Let’s look at LTV in a bit more detail.

The lifetime value of a customer is the average current value of all future cash flows from a typical customer. Just like companies are worth the discounted value of their cash flow streams, customers are worth the discounted value of their cash flow streams.

Several factors influence the lifetime of a customer:

- Average revenue per customer

- Average margin per customer

- Churn

- Expansion

#2 Revenue / Customer

Beyond total revenue, investors will want to see what your revenue / customer is. Keep in mind that low revenue / customer doesn’t necessarily spell doom for your business, but it does decrease the lifetime value of a customer. Again, this doesn’t mean your business will fail. If you have strong customer retention and / or your customers are inexpensive to acquire, your business model could still be a resounding success.

There are a number of ways to increase your revenue / customer:

- Upsell customers to higher value / more expensive product

- Sell add-on products and services

- Add new features to your product

- Find customer segments that are less price sensitive

- Expansion

Expansion refers to how much you can grow your revenue among your current customers. If your business typically increases the amount of revenue it gets from customers over time, this will increase your LTV.

#3 Margin / Customer

While revenue is almost never a bad thing, it’s not always a profitable thing. Investors understand the shaky relationship that startups have with profitability, so what they want to see is not necessarily real-time profits, but potential “profits-to-be.” One of the ways they determine future profits is by looking at gross margin.

Businesses that operate on low gross margins tend to have a hard time scaling and are often significantly less valuable. If investors see that your business has a low gross margin, you may not be able to find investment for your business.

Luckily for you, there are many ways to increase your margins. Here are a few examples:

- Streamline costs internally

- Look for ways to save on support without losing too much quality (like using chat instead of phone conversations)

- Provide self-service options for your product

#4 Churn

Churn refers to how frequently customers stop using your service, and is also known as revenue losses. In a way, churn trumps both revenue / customer and gross margins. If you score high in both of those metrics, but you lose these high margin customers shortly after you acquire them, your business model may not make sense.

There are many ways to decrease churn:

- Better customer support

- Better account management

- Ensuring customers actively use your product

- Reminding your customers about the value of your product

- Identifying leading indicators of churn and addressing those rapidly

#5 CAC

Customer acquisition cost (CAC) refers to the cost of acquiring a new customer. One simple formula for CAC is:

Average Monthly Sales and Marketing Expense / Average Monthly Number of New Customers

Acquiring customers on the cheap is a massive indicator of business value, and you can bet that investors will take notice.

Again, you’re in luck because there are plenty of ways to decrease your CAC:

- Increase the virality of your product

- Increase the number of referrals you get for your product

- Exploit lesser-known marketing strategies that aren’t as competitive

- Use inexpensive one-to-many marketing strategies rather than scaling large sales teams

#6 Lifetime Value of a Customer (LTV)

All of this brings us to perhaps the most important metric of all LTV. Lifetime value of a customer tells your investors how much each new customer is worth taking into account customer acquisitions costs, margins, churn, etc.

The rough math looks like this:

VCs can look at this and do some simple math around how much your company is worth and how much of a return they should get on their investment.

Now, to be sure, VC investments are fraught with risk just like the startups the money funds. Nothing is a guarantee. Companies and market dynamics change all the time. But this metric is one of the most important all-encompassing estimates of how attractive your company is financially.

Staging the statistics

Raising capital for your startup is not a one shot deal. VCs will want to watch you grow and decide whether or not to dish out more money throughout your stages of growth. As you move into later stages of funding series, you may even want to find new investors and stakeholders to support your business.

CB Insights conducted research to get a better insight into how many startups make it to unicornhood. On the reverse side, their research also covers where along the funding funnel startups tend to lose traction from VCs. They studied a cohort of 1,098 startups who raised seed funding in either 2008, 2009, or 2010, following them throughout their funding stages until February 28 of this year. These are some of their findings:

- Close to half (46%) of companies that raised their initial seed in 2008–2010 ended up raising a second round of funding.

- 306 (28%) of companies that raised a seed round in 2008–2010 exited through an M&A or IPO within 6 rounds of funding.

- 70% of companies end up either dead, or become self-sustaining (maybe great for the company but not so great for investors).

- The median seed disclosed deal size was $400K while the average was $700K, and the gap between median and average round sizes increases over time, showing that mega-rounds in later stages skew the average upward. By the fifth follow-on round, the median round amount was $40M but the average was $175M.

- 61% of companies that raise a follow-on after their initial seed are then able to raise a second follow-on round after that. In other words it is easier for companies to raise a second post-seed financing than a first post-seed financing—it is easier for companies to raise a Series B than a Series A.

WHILE IT’S NOT NECESSARY FOR EVERY STARTUP TO BECOME A UNICORN, IT IS CRITICAL FOR STARTUPS TO CONTINUE RAISING FUNDS WHILE THEY FOCUS ON BECOMING PROFITABLE. THAT IS WHY IT IS SO IMPORTANT FOR STARTUPS TO NOT ONLY FOCUS ON THE PREVIOUSLY MENTIONED METRICS FOR THEIR FIRST ROUND OF FUNDING, BUT FOR EVERY STAGE OF GROWTH.

Conclusion

However you slice it, the startup game is going to be a risky one. But that doesn’t mean you have zero control over the success of your business. One of the best things you can do for your burgeoning enterprise is to position it in an appealing light to venture capital investors.

If there’s one main thing you should take away from this article, it’s that VCs are first and foremost concerned about return on investment. If you want their capital, show them how you can take their investment and spin it into gold. You can do this by wowing them with the metrics mentioned in this article.

If your metrics are less than impressive, you should try to improve them before trying to raise money, otherwise you may be wasting your time. However, if you have a portfolio of dazzling metrics and you can prove that your business is a seedling ready for massive growth, you’ll have investors beating a path to your door.

Good luck and let us know if we can answer any questions!