Cash is the lifeblood of your company, which is why, as a VP of finance, it’s critical to track and be aware of your Free Cash Flow. To do this, you need to know how much money is going into and coming out of your business. That way you know if there’s enough cash to cover payroll, rent, utilities, and other general overhead, as well as how much uncommitted cash you have available.

The Free Cash Flow metric makes it so that you don’t have to constantly be crunching numbers to know how healthy your company’s finances are.

What is Free Cash Flow?

There are many terms used in the financial world to describe Free Cash Flow. Some commonly used ones include Levered Free Cash Flow (also known as Free Cash Flow to Equity) and Unlevered Free Cash Flow (also known as Free Cash Flow to the Firm). This article focuses on Levered Free Cash Flow, but we’ll simply refer to it as Free Cash Flow (FCF).

Free Cash Flow is the amount of uncommitted money a business has after covering all of its expenses (its capital expenditures and operating expenditures). So after the rent, salaries, utilities, taxes, debts, etc. are paid, the money left over each month represents your FCF.

Why is Free Cash Flow important?

If your company were a reservoir, the water flowing in and out of the reservoir would represent your cash flow. The water flowing into the reservoir represents company income of any form. The water flowing out of the reservoir represents company expenses of any form. The water left in the reservoir represents your FCF that you can use as you choose.

Cash flow metrics can be a good indicator of company health. If there’s more money leaving than entering your company, it won’t be around for long, unless you have significant savings. If expenditures are higher than income in your company, you should make some changes to lower expenses, such as restructuring, revamping the product, or reworking collections.

Knowing that you have a healthy FCF creates options: You could expand, hire more employees, invest more money into product development, pay off debt faster, or add to your savings. Whatever you decide, knowing your FCF will help you make better financial decisions.

What can I learn from a Free Cash Flow metric?

One of the added benefits of tracking your FCF is that it gives you a firm view of your overall earnings and cash flow, in addition to showing your FCF.

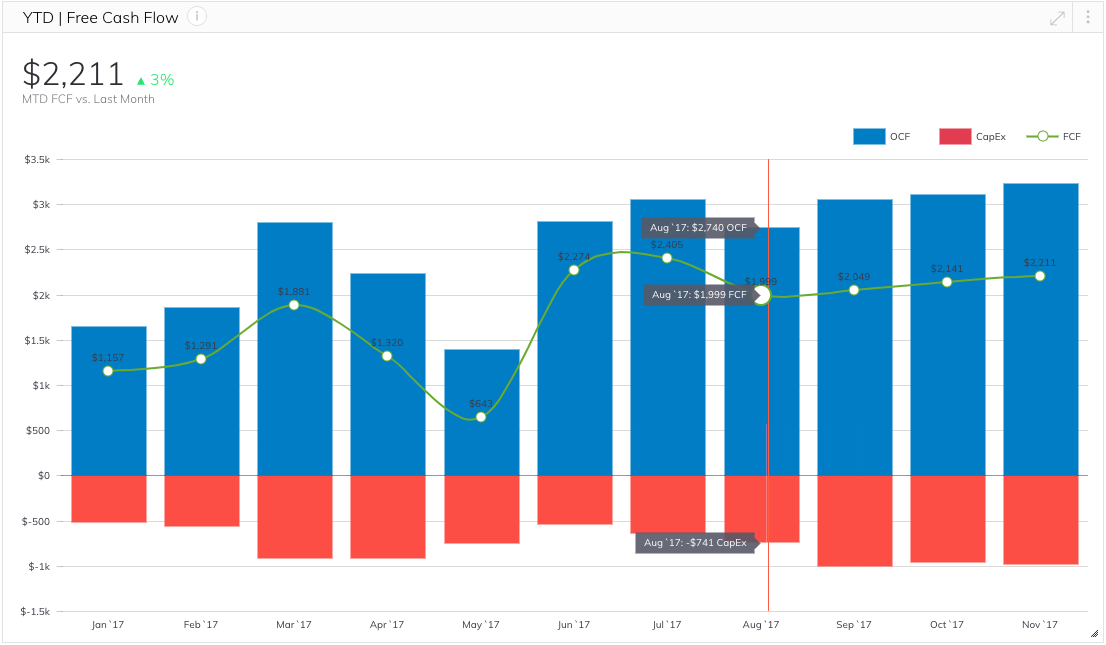

On this Year to Date Free Cash Flow metric, the blue columns extending upwards represent your Operating Cash Flow and the red columns extending downwards represent your Capital Expenditure. The green line with the points represents your FCF for each month. Viewing this data as a column and line chart makes it easy to see how your cash flow changes month-to-month.

If you’re a SaaS company and you have a steady flow of money throughout the year, it can be easier to plan how you will cover your expenses. If you are an ecommerce or similar type of company that experiences seasonality, you can experience times of feast and famine throughout the year. That means you need to make sure to build up savings during high-income periods to keep operating throughout those times when income is low. The FCF metric can help you see those trends so you can ensure that your company’s cash reservoir doesn’t dry up.

How do you calculate your Free Cash Flow?

To calculate your FCF, you are going to need a few numbers. You’ll need to know you’re earnings before Interest and taxes (EBIT). EBIT is also known as your operating income. You’ll also need to know your tax rate, be able to calculate the depreciation and amortization of any of your assets, know your net working capital, and your capital expenditures.

Here’s a free cash flow formula:

Free Cash Flow = EBIT (1 – Tax Rate) + Depreciation + Amortization – Change in Net Working Capital – Capital Expenditures

What if you have a negative Free Cash Flow?

Suppose your finances were hooked up to a metric like the one above, but your red column was larger than your blue column (indicating that your FCF is negative). Do you need to worry?

It depends.

Has your FCF been in the negative for a long period of time? Is your FCF negative because you recently made a purchase that should increase your company’s ability to generate profits? Is this a one-time occurrence? Your answers to these questions will help you know if you should worry about the financial health of your company.

If your expenses have exceeded income (which is sometimes planned) and you don’t have the funds to operate like that for a much longer, you need to make changes to correct it as soon as you can.

If you recently made a large purchase like upgrading equipment, renting a new office space, hiring new employees, etc., in an effort to increase your company’s ability to generate profits, then you don’t have to worry as long as profits actually start to increase.

If it was a one-time, planned or unplanned, occurrence then you should be fine. But it would be a good idea to place some of your future FCF into savings so you have a cushion.

Keep in mind, it’s normal for young, growing companies to have a negative FCF, but it’s a red flag for mature larger companies to have a negative FCF.

How do I create a Free Cash Flow metric?

The metric above was created with Grow. If you use Quickbooks or Zoho Books to keep your finances up-to-date, Grow can pull data from those platforms to create a metric like the one above.

To see if Grow integrates with your financial platform, view our integrations here.